By David Arbit on Friday, June 26th, 2015

COMPARING SQUARE FOOTAGE TRENDS IN THE NEW CONSTRUCTION AND PREVIOUSLY OWNED SEGMENTS

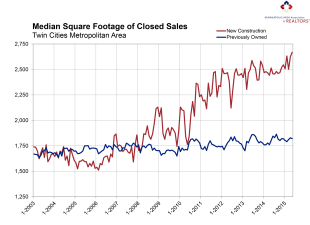

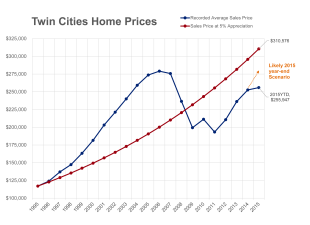

New construction prices not only recovered far faster than previously owned prices, but they have also reached an all-time high (see chart). The median sales price for new construction was about $268,000 in 2009 but has since soared to new highs of just over $376,000. Previously owned prices, by contrast, reached $228,000 in 2006 but are now at $205,000. What’s driving this, you ask?

A multitude of factors have encouraged new home prices to stretch to new heights. Builders, contractors and suppliers will tell you that input costs have risen and that is true. Labor, copper, concrete, PVC, drywall and other related commodity prices have all risen lately. Steel prices, however—which make up a small share of overall construction costs—have fallen as China has flooded the global market with cheap steel. China now produces as much steel as the rest of the world combined. Lumber prices increased over the last few months, but have mostly declined since 2013. Lumber prices on the Chicago Mercantile Exchange are on-par with 2010. Let’s not digress too much.

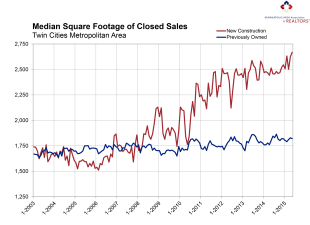

Something else noteworthy is happening, and this graph illustrates it pretty well. Though perhaps unsurprisingly, the total square footage of new construction is increasing at a far faster rate than the previously owned segment. Between May 2005 and May 2015, the median square footage of newly constructed homes rose 65.2 percent. During that same period, the median square footage of previously owned properties only increased 7.1 percent. For new construction, the typical home was built with 1,614 total finished square feet in 2005 but that figure grew to 2,667 total finished square feet by 2015. By contrast, the typical resale home had 1,700 square feet in 2005 but has only risen to 1,821 square feet as of May of this year. Interestingly, previously owned homes tended to be larger than new construction in 2005.

The nature of previously owned properties is that they don’t change that much. Those properties are already built. The 7.1 percent increase can be explained by two different dynamics. First, those who are selling and buying resale homes are tending to list and purchase slightly larger properties. Second, through remodeling projects such as a master bedroom addition or finishing off a basement or attic space, the existing housing stock can increase in finished square footage even though the foundation is already in the ground.

So what does this all mean? Well for one thing, those who have ruled out purchasing a newly built home because prices are at all-time highs might reconsider once they realize what’s causing that. Builders are constructing larger and larger homes, but not every newly built home is enormous and over $1 million. In fact, new construction can be fairly competitive with existing resale properties in certain areas and price points. Additionally, though the median sales price is at an all-time high, the price per square foot is not even back to bubble levels (see chart).

Another factor to keep in mind is that a lot of new construction in 2005 was condo-centric, particularly in and around both downtowns. As the condo bubble burst, development shifted toward single family products on larger suburban lots. Condos obviously tend to be smaller than single family homes, so that was certainly constraining square footages 10 years ago. In other words, a low baseline can impact this sort of analysis as much as if not more so than the current period. The large increase in new construction may be explained by a low 2005 figure as opposed to a high 2015 figure, though both dynamics

As we become ever more cognizant of energy efficiency, carbon footprints, insulation and everything that comes with it, there is some anecdotal evidence that smaller housing products are gaining popularity and it seems to be consumer-driven. There are even entire communities of “micro homes” (see article). So, despite the trend in new construction, perhaps bigger won’t always be better.