Buyers don’t live in a spreadsheet. When they find a home to love and cherish, they don’t intellectualize it too much. There are generally fewer homes on the market, they’re selling more quickly and prices in most areas are no longer in a downtrend. Dwindling inventories means there’s less competition and more pricing power for sellers, who are finally starting to be rewarded by strong buyer activity. Interest rates at 50-year lows doesn’t hurt either. Love is in the air and all around the housing market.

In the Twin Cities region, for the week ending April 28:

- New Listings decreased 14.9% to 1,475

- Pending Sales increased 21.4% to 1,187

- Inventory decreased 28.0% to 17,603

For the month of March:

- Median Sales Price increased 7.1% to $149,900

- Days on Market decreased 9.7% to 144

- Percent of Original List Price Received increased 3.8% to 92.1%

- Months Supply of Inventory decreased 37.2% to 4.8

Category Archives: Uncategorized

Weekly Market Report

There’s that sound again. It’s the media message you once heard on the TV and radio or read in newspapers and on the Internet in days seemingly long gone. Real estate stories are mostly being cast in a generous light. That’s all well and good, but is now the time to list or buy? Answering that question still relies upon many specific, localized, determining factors, but we have reached a place where the process is generally more positive and enjoyable. That big American dream of homeownership is no longer haunted by night terrors.

In the Twin Cities region, for the week ending April 21:

- New Listings increased 13.9% to 1,677

- Pending Sales increased 41.2% to 1,281

- Inventory decreased 28.4% to 17,447

For the month of March:

- Median Sales Price increased 7.1% to $149,900

- Days on Market decreased 9.7% to 144

- Percent of Original List Price Received increased 3.8% to 92.1%

- Months Supply of Inventory decreased 37.6% to 4.7

Washington County Offers Zero-Interest Loans for Home Projects

Loans of up to $18,000 are being offered to homeowners with no interest, no monthly payments and repayment deferred until home is sold or transferred.

March Monthly Skinny Video

Pending Home Sales Highest Since 2005!

There were 3,149 purchase agreements signed in the 13-county Twin Cities metropolitan area during January, a 25.5 percent increase over last January. No doubt driven by a mix of record-low mortgage rates, affordable prices, strong negotiating leverage and unseasonably warm weather, that’s the highest January pending sales figure since 2005.

Sellers were less active, as new listings fell 9.0 percent from January 2011 to 5,112 properties. The number of homes for sale continued to drop, as well, down 28.1 percent from last year to 16,463 active listings – the lowest inventory reading for any month since 2003. Another important housing metric, months supply of inventory, remained at a six-year low of 4.6 months.

“If you look deeper into the strong sales figures, you can see which segments are leading the charge,” said Cari Linn, President of the Minneapolis Area Association of REALTORS®. “With inventory down, especially among foreclosures, and good purchase demand, buyers are finally looking harder at traditional properties.”

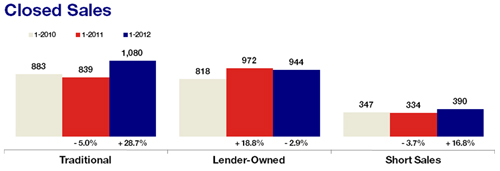

Traditional sales surged 28.7 percent, while foreclosure sales fell 2.9 percent and short sales increased 16.8 percent. For sellers, the landscape is shifting. For six consecutive months, sellers received progressively more of their asking price than they did the year prior. In January, sellers received an average of 91.2 percent of their original list price.

Sellers are also watching market times closely. The average number of days a listing spends on the market before closing was down 8.3 percent to 142 days—the fourth consecutive year-over-year decrease. But those looking to sell their properties should be aware of distressed market activity.

In January, 43.2 percent of all new listings were either foreclosure or short sales. Together these lender-mediated properties made up 55.3 percent of all closings. Homes in financial distress are exiting the marketplace faster than they are entering it, but they have still managed to prevent market-wide price appreciation. The median sales price was down a modest 3.4 percent from January 2011 to $140,000, marking the smallest decline since November 2010.

“Price declines are subsiding, partly thanks to changes on the supply-side of the equation. Rising home prices will still be the final phase of recovery,” said Andy Fazendin, MAAR President-Elect. “We firmly believe that what we’re seeing now is setting the stage for better times ahead.”

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start blogging!