It was a week full of intrigue if ever there was one. A positive jobs report gave way to bullish activity on Wall Street backed by heroics from the hometown team, as the Giants showcased their Manning(ham) magic. Meanwhile, dozens of state attorneys general brokered a deal that will likely include principal write-downs. In local housing news, buyers made more purchases while sellers listed fewer properties than during the same week in 2011. Other indicators have recently showcased key improvements elsewhere in the marketplace. The most notable trend is fewer active listings. Buyers in wait-and-see mode may find themselves with more competition for fewer properties come spring.

In the Twin Cities region, for the week ending February 4:

- New Listings decreased 6.7% to 1,236

- Pending Sales increased 35.8% to 888

- Inventory decreased 23.2% to 17,697

For the month of January:

- Median Sales Price decreased 3.4% to $140,000

- Days on Market decreased 8.4% to 142

- Percent of Original List Price Received increased 3.4% to 91.2%

- Months Supply of Inventory decreased 35.2% to 4.6

Category Archives: The Skinny

Weekly Market Report

Whether motivated by the election cycle, a jump in employment, improving housing market metrics or the best start to a year for the S&P 500 since 1989, home buyers posted increased activity levels compared to last year. Consumers signed more purchase agreements but sellers entered into fewer listing contracts. Changes in supply-side metrics confirm this, suggesting that relatively less new product is entering the market compared to buyer demand. That’s helped other metrics return to more friendly territory. Whatever the reason, it’s good to see that vote of confidence.

In the Twin Cities region, for the week ending January 28:

- New Listings decreased 17.5% to 1,090

- Pending Sales increased 22.9% to 833

- Inventory decreased 23.5% to 17,762

For the month of December:

- Median Sales Price decreased 6.5% to $145,000

- Days on Market decreased 2.1% to 141

- Percent of Original List Price Received increased 1.7% to 90.6%

- Months Supply of Inventory decreased 33.3% to 4.8

Weekly Market Report

As the first month of the year trots onward, so do home buyers. They posted increased activity levels compared to the same week in 2011. Seller activity slowed compared to last year, however. Inventory declines effectively positioned many local markets into a more balanced state – particularly toward the end of last year. Increased seller activity in the coming months could slow or even reverse that trend. Don’t fret. Not only is an increase in new listings perfectly normal for this time of year, but improved absorption rates and seller concessions could begin to stew into seller confidence.

In the Twin Cities region, for the week ending January 21:

- New Listings decreased 8.2% to 1,092

- Pending Sales increased 29.0% to 730

- Inventory decreased 23.2% to 17,822

For the month of December:

- Median Sales Price decreased 6.5% to $145,000

- Days on Market decreased 2.1% to 141

- Percent of Original List Price Received increased 1.7% to 90.6%

- Months Supply of Inventory decreased 33.7% to 4.7

Weekly Market Report

Last week, the Mortgage Bankers Association reported that mortgage applications increased more than 23.0 percent from the week prior. The fine print stated that most of the increase was driven by refinancing activity, given record low rates. Residential construction data also provided glimmers of hope. By now, many have surely noticed that the supply-demand balance is changing. What some may not realize is that this is a leading indicator, while home prices are a lagging indicator. Price appreciation is the final phase of recovery. Excess supply is down–in some areas, it’s way down. Purchase demand in most areas strengthened throughout the second half of 2011. For sellers, it’s less scary out there. For buyers, it’s still a once-in-a-lifetime opportunity.

In the Twin Cities region, for the week ending January 14:

- New Listings decreased 5.2% to 1,216

- Pending Sales increased 28.4% to 728

- Inventory decreased 23.8% to 17,690

For the month of December:

- Median Sales Price decreased 6.5% to $145,000

- Days on Market decreased 2.5% to 140

- Percent of Original List Price Received increased 1.7% to 90.6%

- Months Supply of Inventory decreased 35.6% to 4.6

January Monthly Skinny Video

2011 Annual Wrap-Up: Lower Prices but a Healthier Market

Decreased supply, high demand and low prices are among the encouraging developments in 2011 that give cause for optimism in 2012. Consumer purchase demand increased absent any outside incentives. As the active supply of homes for sale decreased dramatically, absorption rates improved to levels not seen since 2005. Unprecedented low interest rates and record housing affordability resulted in an 8.2 percent increase in home sales for the area.

2011 by the Numbers

- Consumers purchased 41,429 homes, up 8.2 percent from 2010 and—excluding 2009—the highest since 2006.

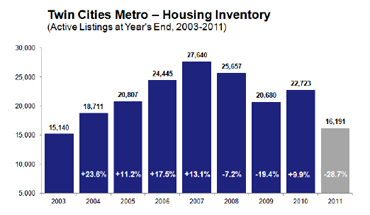

- Sellers listed 68,875 new homes on the market, down 15.8 percent from 2010 and the lowest level since 2002. Inventory levels dropped 28.7 percent from 2010 and are at the lowest level in 8 years.

- Months supply of inventory—the time it would take to sell off all active properties—dropped 36.5 percent to 4.5 months.

- The median sales price fell 11.7 percent to $150,000.

- Precisely 50.0 percent of all closed sales were either foreclosures or short sales, up from 47.9 percent in 2010 and 48.9 percent in 2009.

“We are pleased with the recovery we saw in 2011,” said Richard Tucker, President of the St. Paul Area Association of REALTORS®. “Median sales price reflects the mix of properties sold during the year—and in 2011 a lot moved in that lower bracket. Price increases will be the final piece of the recovery.”

Distressed properties were the driving factor of home prices, selling for roughly 60 cents on the dollar compared to traditional homes.

“Homeowners need to remember that median sales price does a better job of reflecting what’s going off the market as a whole than representing the home values in a given area—each area is unique,” said Cari Linn, President of the Minneapolis Area Association of REALTORS®.

Improvements in the local economy will boost the Twin Cities real estate market in 2012. The outlook is positive: steady hiring, lessening layoffs and record low unemployment are all reasons the area continues to outperform the nation.

For other year-end residential real estate statistics and for stand-alone December 2011 data, please visit www.mplsrealtor.com and www.spaar.com.

Weekly Market Report

The first full week of 2012 shows that buyers were off to a busy start while seller activity cooled down. Sales volumes easily beat the same week in 2011. The inventory drops that many communities saw during the second half of last year should translate into further positive news for sellers. Interest rates are expected to hold the low ground, enriching the buying environment for consumers. It’s early now. The spring market will ultimately be the major tell as to the rate of recovery throughout the year. Today’s lesson: Maintain a long-term perspective and watch trends develop beyond one week of data.

In the Twin Cities region, for the week ending January 7:

- New Listings decreased 14.6% to 1,266

- Pending Sales increased 13.8% to 561

- Inventory decreased 24.5% to 17,302

For the month of December:

- Median Sales Price decreased 6.5% to $145,000

- Days on Market decreased 2.5% to 140

- Percent of Original List Price Received increased 1.7% to 90.6%

- Months Supply of Inventory decreased 35.6% to 4.6

The attached Weekly Market Activity Report is produced by the Minneapolis Area Association of REALTORS® (MAAR) for REALTOR® members and interested parties on a weekly basis. Use it to further your understanding of the Twin Cities 13-county residential real estate marketplace.

Weekly Market Report

Most observers would agree that this year’s housing recovery was not as robust as many had hoped. That said, a handful of things went right. Supply-side market correction took the guise of inventory declines and a pullback in listing activity. Consequently, sellers generally faced fewer challenges than in the past. Driven by improvements in the economy and record-low mortgage rates, purchase demand strengthened organically, independent of government incentives. Those sales gains dovetailed with falling inventories to move the market back toward balance. Nobody knows what 2012 will bring, but it’s a safe bet that these positive developments will continue to evolve.

In the Twin Cities region, for the week ending December 31:

- New Listings decreased 11.6% to 593

- Pending Sales increased 41.7% to 564

- Inventory decreased 24.9% to 18,341

For the month of December:

- Median Sales Price decreased 5.6% to $145,000

- Days on Market decreased 2.4% to 140

- Percent of Original List Price Received increased 1.8% to 90.6%

- Months Supply of Inventory decreased 36.2% to 4.6

The attached Weekly Market Activity Report is produced by the Minneapolis Area Association of REALTORS® (MAAR) for REALTOR® members and interested parties on a weekly basis. Use it to further your understanding of the Twin Cities 13-county residential real estate marketplace.

Weekly Market Report

If you follow our weekly notes with even a sidelong glance, you know that the story of the market in 2011 has been increased sales and decreased inventory. That’s all well and good, but consumers and the media want to talk about one thing: Price. Ideally, sellers seek multiple offers. This signals strong demand and competitive bidding. Buyers want to know that purchasing a home is a financially sound investment. Consumers, whether buyer or seller, want to know when we’ll be establishing a stable real estate foundation again. Which is exactly why the tale of increased sales activity and healthy inventory absorption matters.

In the Twin Cities region, for the week ending December 24:

- New Listings decreased 9.6% to 596

- Pending Sales increased 48.4% to 607

- Inventory decreased 24.4% to 18,666

For the month of November:

- Median Sales Price decreased 10.2% to $149,000

- Days on Market decreased 1.8% to 135

- Percent of Original List Price Received increased 1.0% to 90.9%

- Months Supply of Inventory decreased 29.8% to 5.7

- Inventory decreased 24.4% to 18,666

The attached Weekly Market Activity Report is produced by the Minneapolis Area Association of REALTORS® (MAAR) for REALTOR® members and interested parties on a weekly basis. Use it to further your understanding of the Twin Cities 13-county residential real estate marketplace.

Weekly Market Report

As another new year approaches, we find ourselves settling in for the holidays, which typically come with slowed real estate activity. In the first week of the full holiday shopping season, we saw sales increase. We’re talking about residential real estate, of course, although retail performed surprisingly well, too. Sellers listed fewer properties during the week, choosing instead to hunker down in their living rooms rich with the aromas of pine-scented candles and cinnamon cider sticks.

In the Twin Cities region, for the week ending December 3:

- New Listings decreased 9.3% to 1,006

- Pending Sales increased 36.4% to 885

- Inventory decreased 22.9% to 20,031

For the month of November:

- Median Sales Price decreased 9.9% to $149,500

- Days on Market decreased 1.8% to 135

- Percent of Original List Price Received increased 1.0% to 90.9%

- Months Supply of Inventory decreased 30.5% to 5.7

The attached Weekly Market Activity Report is produced by the Minneapolis Area Association of REALTORS® (MAAR) for REALTOR® members and interested parties on a weekly basis. Use it to further your understanding of the Twin Cities 13-county residential real estate marketplace.