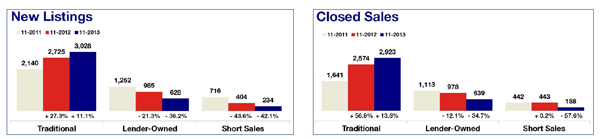

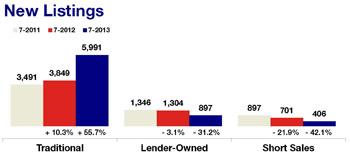

It’s imperative to understand market activity by segment. Buyers are now leaning toward traditional purchases first because they are making up a greater share of the marketplace. These properties also tend to be in better condition, many come with warranties and traditional sellers tend to be more cooperative than banks. New traditional listings rose 22.1 percent compared to March 2013, while foreclosure and short sale new listings fell 39.9 and 53.8 percent, respectively.

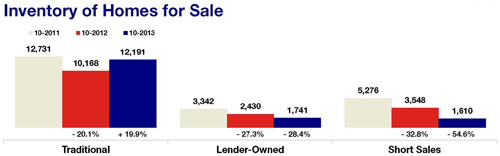

On the demand side, pending sales declined 8.4 percent to 4,141 properties overall, which still reflects less distressed market activity. Once again, traditional pending sales were up 2.6 percent while pending foreclosure and short sales fell 32.2 and 45.1 percent, respectively. Consumers shopping for homes now have 13,086 properties to choose from – or 4.1 percent fewer than last year at this time, marking the smallest year-over-year decline since November 2013.

“There’s a lot of excitement and positive energy out there, especially among sellers,” said Emily Green, President of the Minneapolis Area Association of REALTORS® (MAAR). “Some would-be sellers have been lifted out from underwater by rising prices and less competition from foreclosures, while other move-up buyers are also eager to buy.”

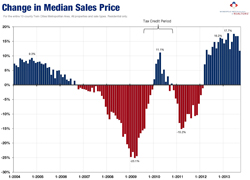

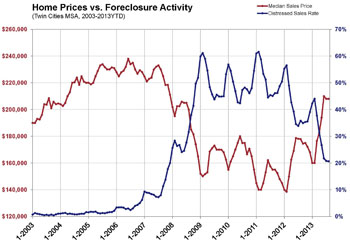

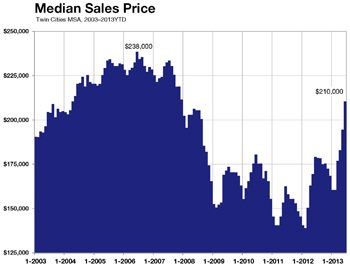

The lowest price point of the market is evaporating. As a result, the median sales price for the metro rose 7.6 percent to $190,000, marking 25 straight months of year-over-year price gains. Last March, foreclosures and short sales made up 25.2 percent of all new listings. This March, they made up just 13.3 percent. For closed sales, the number fell from 37.6 to 26.6 percent.

On average, homes spent just 95 days on the market, 12.0 percent less than last March. Sellers are receiving an average of 95.0 percent of their original list price. The Twin Cities now has 3.1 months’ supply of inventory, suggesting a favorable selling environment. Importantly, interest rates remain affordable and well below their long-term average.

“Traditional properties are dominating the market again,” said Mike Hoffman, MAAR President-Elect. “As distressed product clears the pipeline, consumers are more likely to embark upon negotiations and transactions with people rather than banks.”