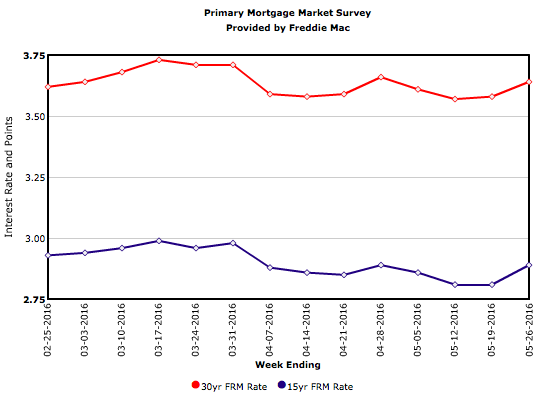

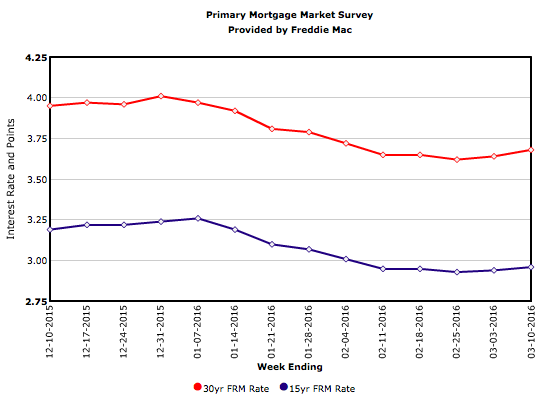

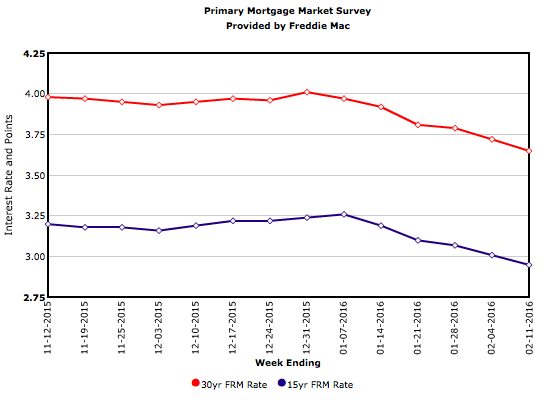

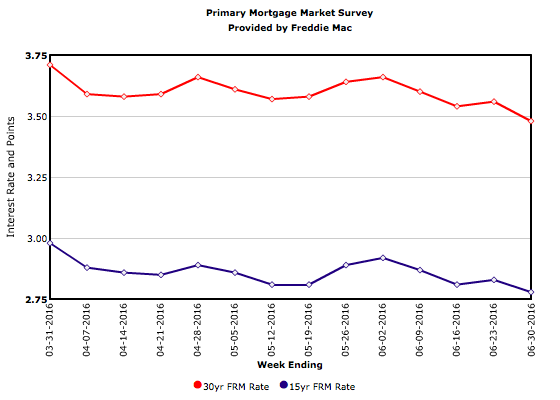

In the wake of the Brexit vote, the yield on the 10-year U.S. Treasury bond plummeted 24 basis points. The 30-year mortgage rate declined 8 basis points to 3.48 percent. This week’s survey rate is the lowest since May 2013 and only 17 basis points above the all-time low recorded in November 2012. This extremely low mortgage rate should support solid home sales and refinancing volume this summer.