Author Archives: Pat Delaney

Weekly Market Report

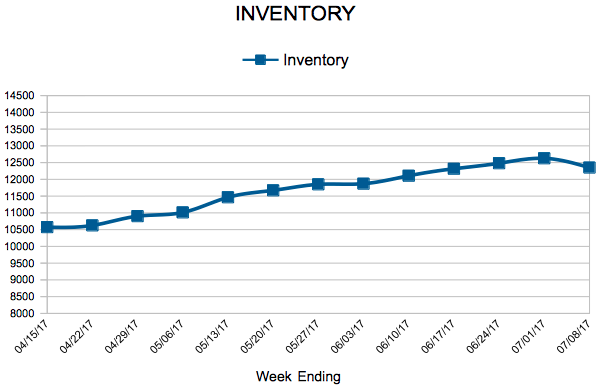

For Week Ending July 8, 2017

From a heart-of-summer perspective, the residential real estate market has performed as expected when predictions were made at the front of the year. Buyer interest is high and inventory is not at a proper level to meet demand. Total sales and new listings are generally behind last year’s levels from week to week, but there is evidence of improvement in both metrics.

In the Twin Cities region, for the week ending July 8:

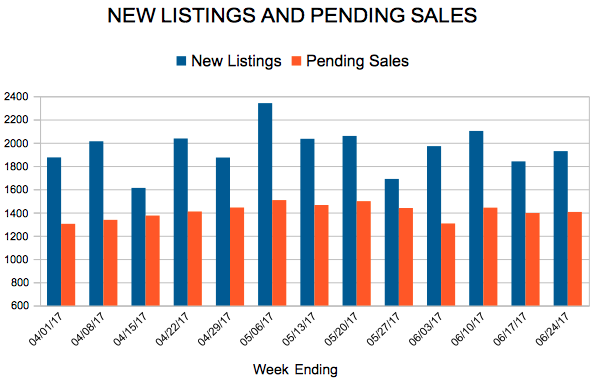

- New Listings decreased 16.9% to 1,371

- Pending Sales decreased 4.7% to 1,061

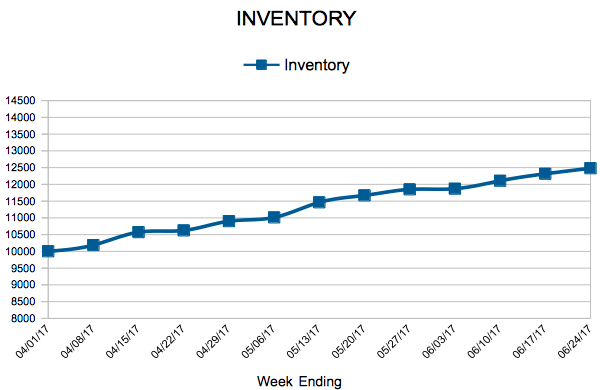

- Inventory decreased 16.7% to 12,351

For the month of June:

- Median Sales Price increased 7.0% to $259,000

- Days on Market decreased 16.1% to 47

- Percent of Original List Price Received increased 0.8% to 99.5%

- Months Supply of Inventory decreased 16.7% to 2.5

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

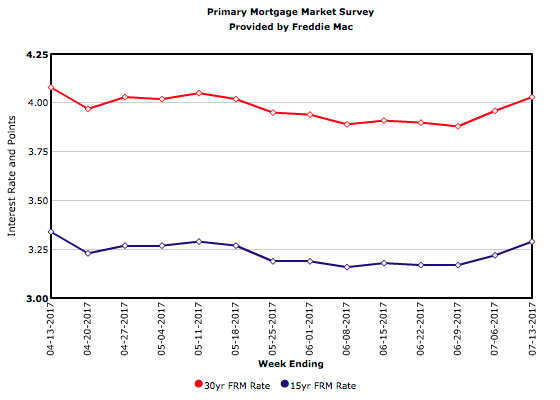

Mortgage Rates Jump Again

New Listings and Pending Sales

Inventory

Weekly Market Report

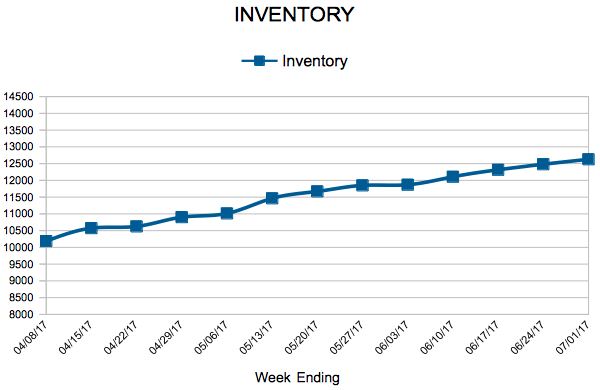

For Week Ending July 1, 2017

Nationally and locally, economic conditions affecting residential real estate have not changed much this year, which is good for market stability. The most recent jobs report was favorable, while unemployment and mortgage rates both remain satisfyingly reasonable. If there were more homes for sale, we might see a shift in prices. Although builder and seller confidence are high, we are not close to a trend change in that regard.

In the Twin Cities region, for the week ending July 1:

- New Listings decreased 0.1% to 1,587

- Pending Sales decreased 5.6% to 1,377

- Inventory decreased 16.5% to 12,628

For the month of May:

- Median Sales Price increased 5.5% to $250,000

- Days on Market decreased 15.0% to 51

- Percent of Original List Price Received increased 0.9% to 99.5%

- Months Supply of Inventory decreased 17.2% to 2.4

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

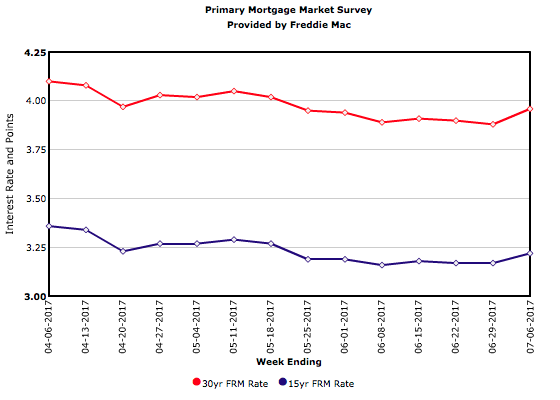

Mortgage Rates Jump

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending June 24, 2017

We are now beyond two years of year-over-year declines in inventory, and it doesn’t look like the situation is going to change anytime soon. However, buyer demand and home prices are still rising, and the number of distressed homes on the market has fallen. It would be great to see more starter homes on the docket for new construction during these next few busy building months to help those that are looking to enter the market.

In the Twin Cities region, for the week ending June 24:

- New Listings increased 1.2% to 1,928

- Pending Sales decreased 1.1% to 1,405

- Inventory decreased 16.3% to 12,481

For the month of May:

- Median Sales Price increased 5.5% to $250,000

- Days on Market decreased 15.0% to 51

- Percent of Original List Price Received increased 0.9% to 99.5%

- Months Supply of Inventory decreased 17.2% to 2.4

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.