Author Archives: Pat Delaney

Inventory

October Monthly Skinny Video

Where has the Twin Cities real estate market been and where is it heading? This monthly summary provides an overview of current trends and projections for future activity. Narrated by David Arbit, Research Manager at the Minneapolis Area Association of REALTORS®, video produced by Chelsie Lopez.

Weekly Market Report

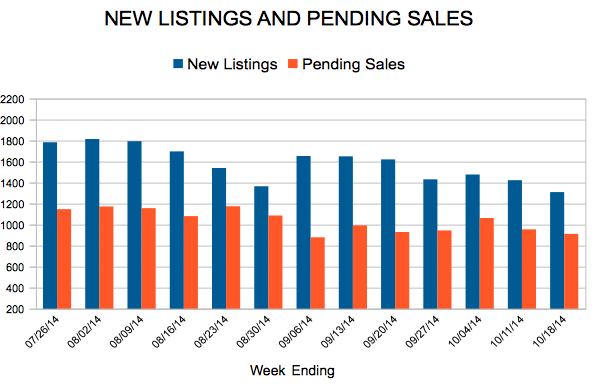

Rising home prices and continued housing stability continue to lure new listings

and keep inventory at a comfortable level. Although things like student debt and

lethargic wage growth may provide some obstacles for first-time home buyers,

those on the hunt for homes are still graced by relatively low inflation and low

mortgage rates. The seasonal slows may settle in soon, but the market remains

mostly content.

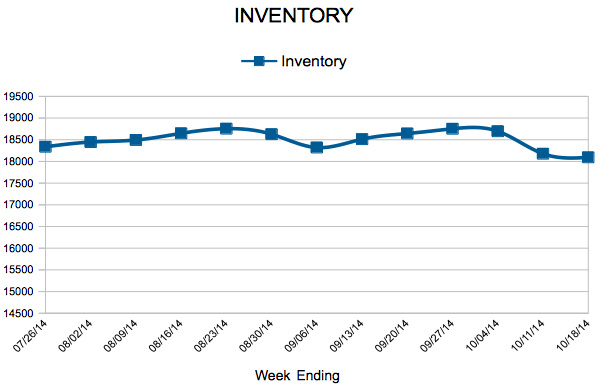

In the Twin Cities region, for the week ending October 18:

- New Listings increased 1.6% to 1,310

- Pending Sales increased 5.1% to 912

- Inventory increased 6.1% to 18,094

For the month of September:

- Median Sales Price increased 5.1% to $204,999

- Days on Market remained flat at 71

- Percent of Original List Price Received decreased 0.9% to 95.6%

- Months Supply of Inventory increased 18.4% to 4.5

All comparisons are to 2013

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

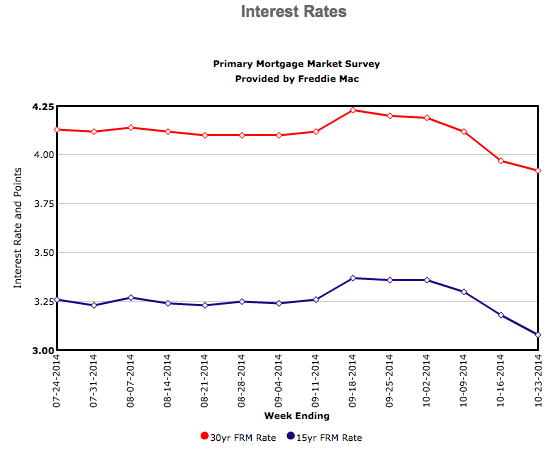

Mortgage Rates Decline Further

On Oct. 23, Freddie Mac released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates hitting fresh lows for the year for the second consecutive week amid declining bond yields. At 3.92 percent the average 30-year fixed rate is at its lowest level since the week of June 6, 2013.

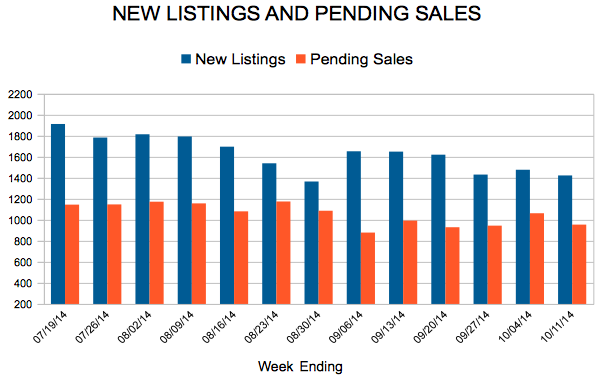

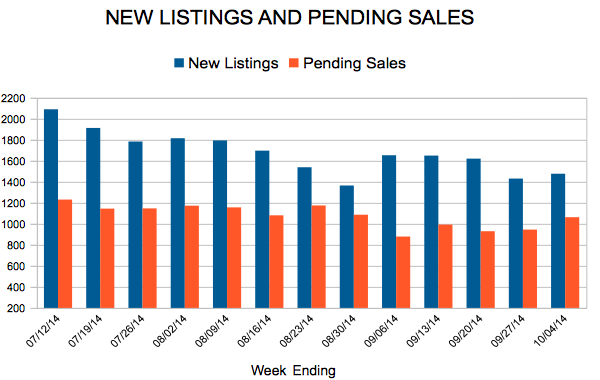

New Listings and Pending Sales

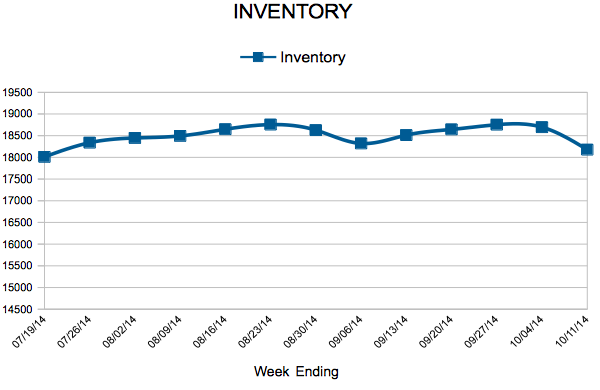

Inventory

Weekly Market Report

As we turn toward the final and typically quietest quarter of the year, it is easy to wonder if we are destined to lose the stability that we have worked hard for throughout the U.S. However, gloomy considerations are readily put aside after considering a recent investigation by the International Monetary Fund into the real estate markets of other countries. It turns out that our national housing price-to- income ratio is fairly conservative. At this rate, we will soon stop talking about the process of housing recovery and just call it recovered.

In the Twin Cities region, for the week ending October 11:

- New Listings decreased 6.6% to 1,423

- Pending Sales increased 6.8% to 955

- Inventory increased 7.5% to 18,178

For the month of September:

- Median Sales Price increased 5.1% to $205,000

- Days on Market remained flat at 71

- Percent of Original List Price Received decreased 0.9% to 95.6%

- Months Supply of Inventory increased 15.8% to 4.4

All comparisons are to 2013

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

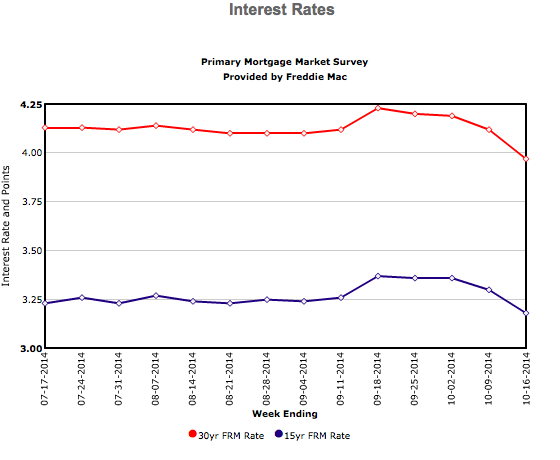

Mortgage Rates Hit New 2014 Lows

Freddie Mac’s October 16 release of the results of its Primary Mortgage Market Survey® (PMMS®) shows average fixed mortgage rates hitting new lows for the year. The average 30-year fixed rate is at its lowest level since the week of June 20, 2013, which was the last time the 30-year fixed averaged below 4 percent in the PMMS until this week.