Author Archives: Pat Delaney

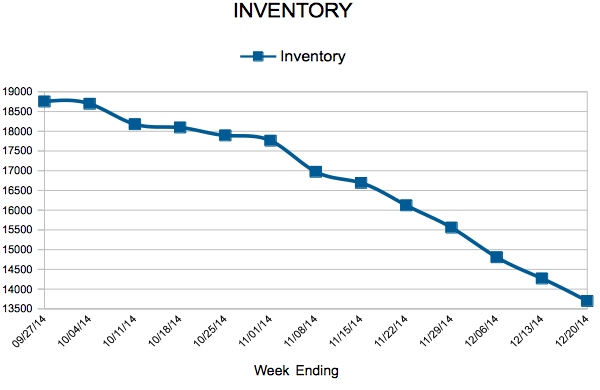

Inventory

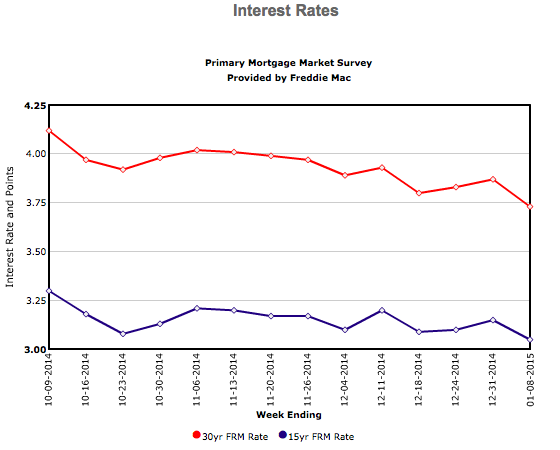

Mortgage Rates Start Year At New Lows

Freddie Mac’s Jan. 8 release of the results of its Primary Mortgage Market Survey® (PMMS®) shows average fixed mortgage rates starting 2015 at their lowest level since May 2013, amid sliding bond yields. A year ago at this time, the 30-year fixed-rate mortgage (FRM) averaged 4.51 percent, and the 15-year FRM averaged 3.56 percent.

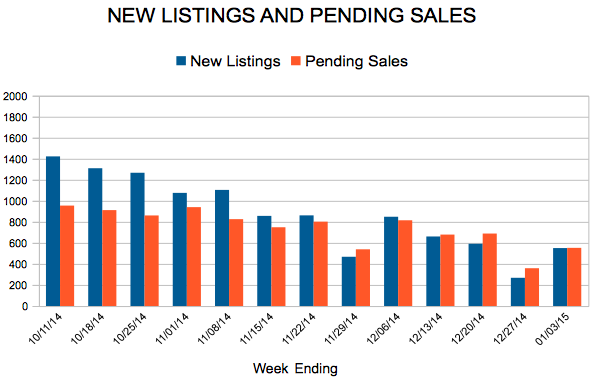

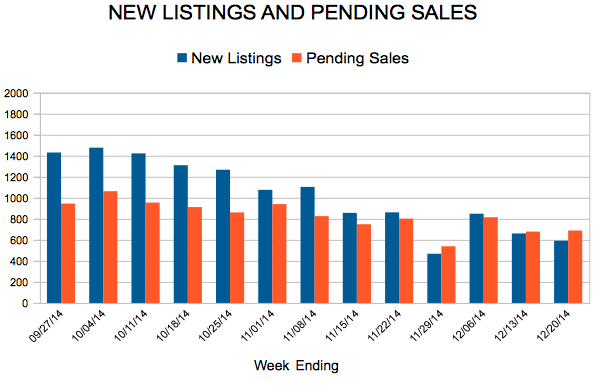

New Listings and Pending Sales

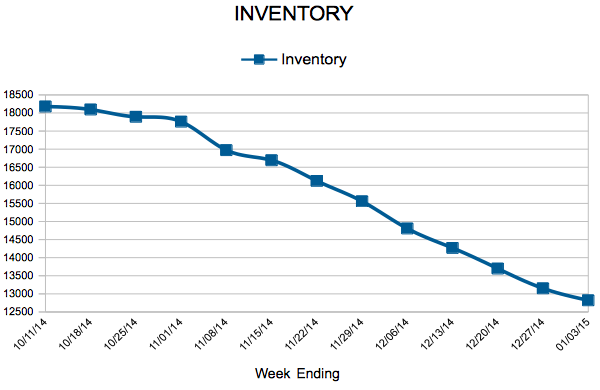

Inventory

Weekly Market Report

It is typically during the final weeks of a calendar year when residential real estate activity hits its seasonal lows, even when some year-over-year comparisons show progress. Don’t be fooled by this time of year. Buyers and sellers are preparing for promising spring and summer markets. Of late, the spring market tends to get hopping before the -ary months are even complete.

In the Twin Cities region, for the week ending December 27:

- New Listings decreased 13.5% to 268

- Pending Sales decreased 9.8% to 359

- Inventory decreased 4.4% to 13,152

For the month of November:

- Median Sales Price increased 5.1% to $205,000

- Days on Market increased 5.3% to 79

- Percent of Original List Price Received decreased 0.7% to 94.7%

- Months Supply of Inventory increased 8.8% to 3.7

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

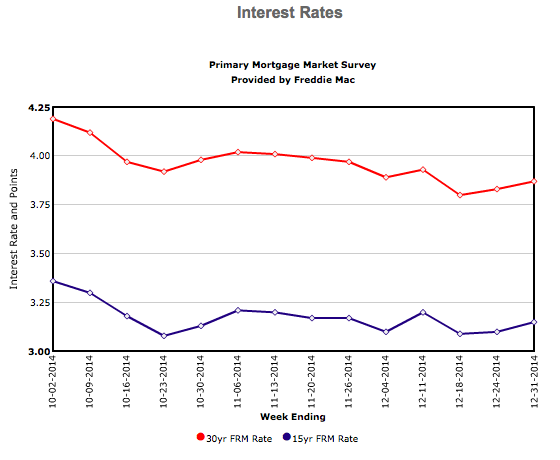

Mortgage Rates End Year Near 2014 Lows

The Dec. 31 release of the results of Freddie Mac’s Primary Mortgage Market Survey® (PMMS®) shows average fixed mortgage rates moving slightly higher this week but still near their 2014 lows. A year ago at this time, the 30-year fixed-rate mortgage (FRM) averaged 4.53 percent, and the 15-year FRM averaged 3.55 percent.

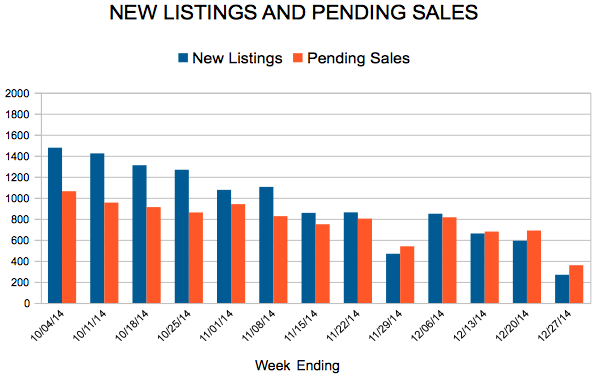

New Listings and Pending Sales

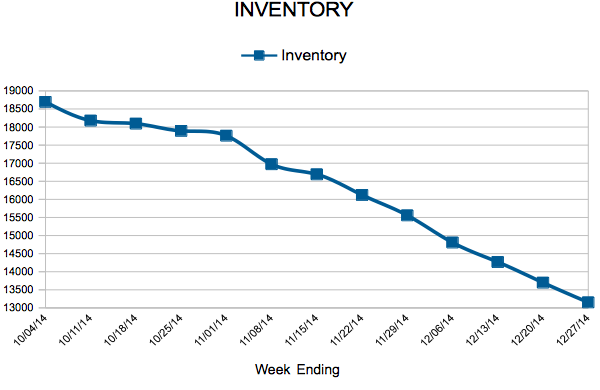

Inventory

Weekly Market Report

Even though interest rates remain low, there is talk of homeownership numbers being at 20-year lows. Tight lending restrictions may be partly to blame for the dip in the number of people flocking to buy a home. A turnover of the trend could be possible in the new year, but during the weeks surrounding the big winter holidays, we all tend to have to play the wait-and-see game.

In the Twin Cities region, for the week ending December 20:

- New Listings increased 6.1% to 592

- Pending Sales decreased 1.3% to 689

- Inventory decreased 4.4% to 13,698

For the month of November:

- Median Sales Price increased 5.1% to $205,000

- Days on Market increased 5.3% to 79

- Percent of Original List Price Received decreased 0.7% to 94.7%

- Months Supply of Inventory increased 8.8% to 3.7

All comparisons are to 2013

Click here for the full Weekly Market Activity Report. From The Skinny Blog.