For Week Ending February 28, 2015

Across the country, some Fortune 500 companies have been raising their

minimum wage. How does this correlate to the housing industry? Mo’ money =

mo’ house-buying powerz. Coupled with the dismantled idea that aging

millennials want to remain at home forever (because, come on, really?), the

housing market is making inroads into two factors that have plagued the buyer

market in recent years. Warmer weather sure can’t hurt either.

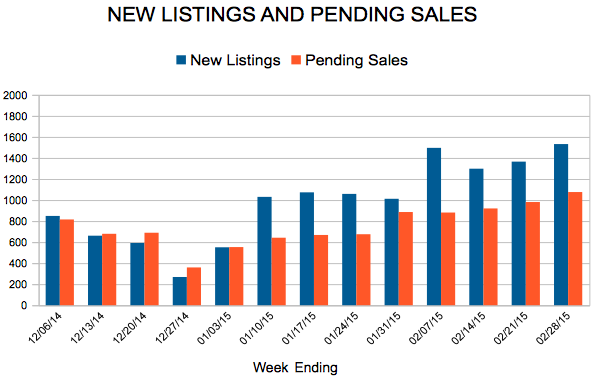

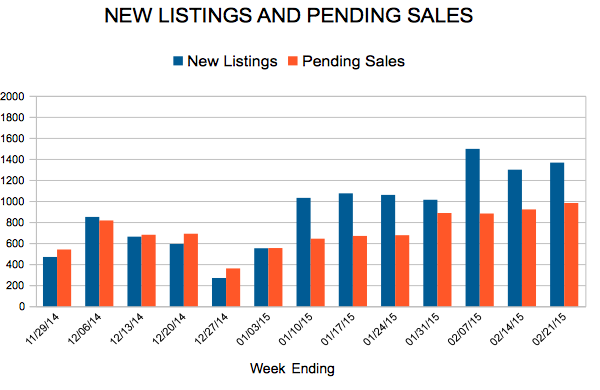

In the Twin Cities region, for the week ending February 28:

- New Listings increased 23.0% to 1,532

- Pending Sales increased 21.0% to 1,076

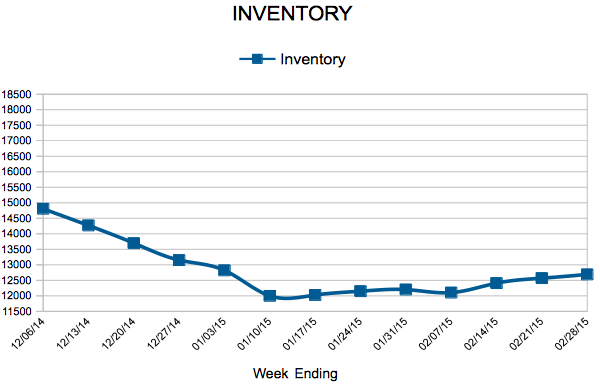

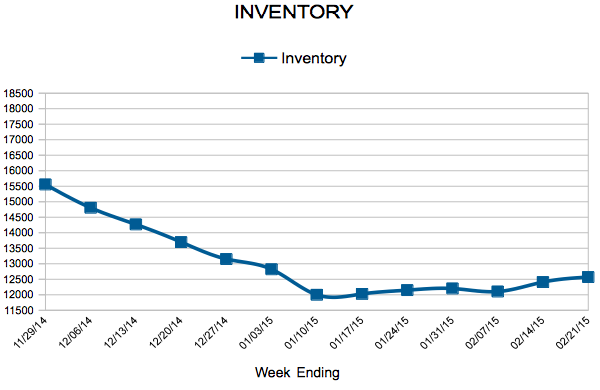

- Inventory decreased 2.2% to 12,690

For the month of February:

- Median Sales Price increased 10.4% to $202,000

- Days on Market increased 7.1% to 106

- Percent of Original List Price Received increased 0.6% to 94.1%

- Months Supply of Inventory remained flat at 3.0

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.