Author Archives: Pat Delaney

Existing Home Sales

Weekly Market Report

For Week Ending July 11, 2015

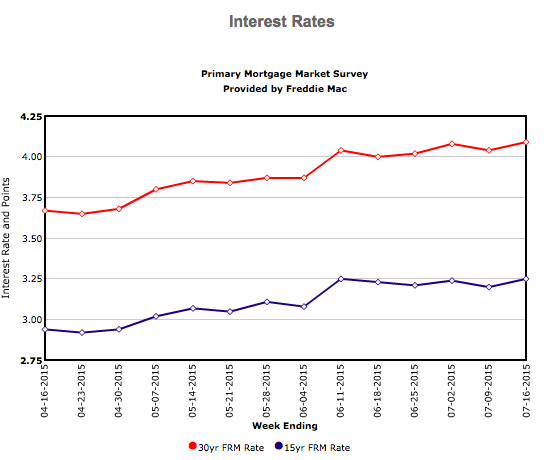

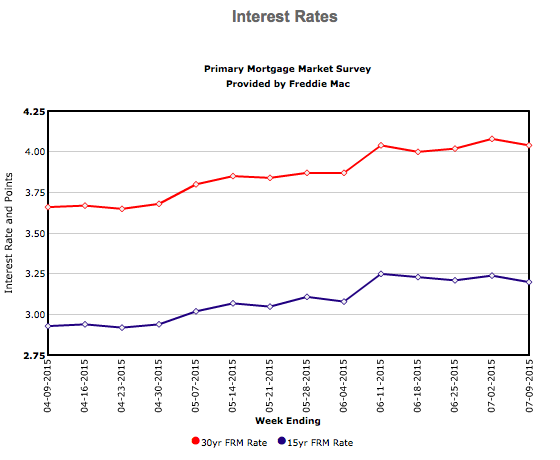

With the economy on the ups these days, the Federal Reserve Chair, Janet Yellen, is predicting a fine-tuning of monetary policy by the end of the year. In tandem with the improving economy, the unemployment rate dropped by 0.2 percent to 5.3 percent for June 2015. It is widely believed that interest rates will go up before the year is over, which is a pretty clear indicator that the housing market is thrumming along at a good clip.

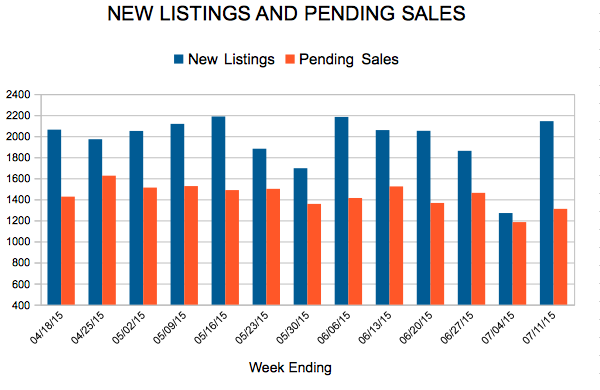

In the Twin Cities region, for the week ending July 11:

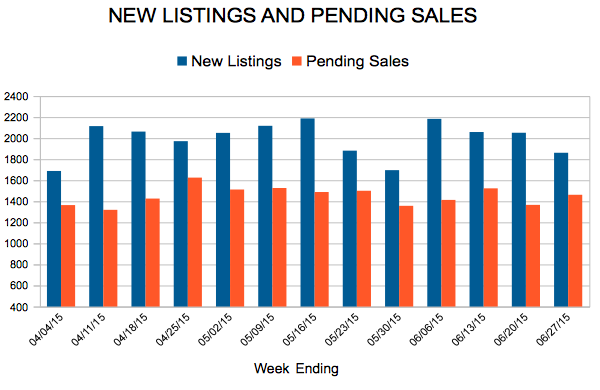

- New Listings increased 2.7% to 2,143

- Pending Sales increased 7.5% to 1,310

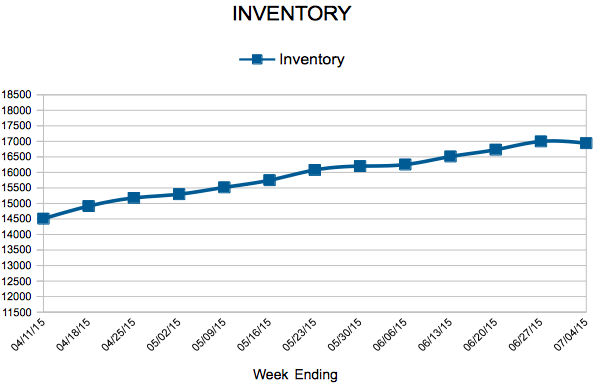

- Inventory decreased 9.0% to 16,655

For the month of June:

- Median Sales Price increased 4.7% to $229,900

- Days on Market decreased 5.7% to 66

- Percent of Original List Price Received increased 0.5% to 97.7%

- Months Supply of Inventory decreased 15.9% to 3.7

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortgage Rates Seesaw Higher

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending July 4, 2015

As fireworks go boom, the boom of housing’s summer selling season tends to relax across the country, giving way to Facebook photos of families and friends at picnics and on road trips. Amidst the red, white and blue Instagram filters and patriotic Twitter profile pics, you’ll still likely see evidence of sales being made and articles about overall affordability. So take a quick break to play catch or chomp a hot dog, because the homeownership dream is alive and thriving this summer.

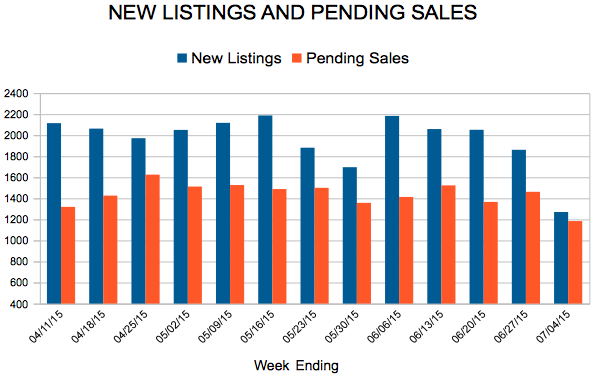

In the Twin Cities region, for the week ending July 4:

- New Listings increased 0.2% to 1,270

- Pending Sales increased 13.3% to 1,184

- Inventory decreased 7.5% to 16,940

For the month of June:

- Median Sales Price increased 4.7% to $229,900

- Days on Market decreased 5.7% to 66

- Percent of Original List Price Received increased 0.5% to 97.7%

- Months Supply of Inventory decreased 15.9% to 3.7

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Pending and Closed Sales Both Reach Highest Level Since June 2005

The Twin Cities metropolitan housing market reached key milestones in June. Both pending purchase demand and closed unit sales officially reached 10-year highs. The last time demand was this strong was June 2005. The number of signed purchase agreements rose 19.2 percent to 6,266. Closed sales increased 22.0 percent to 6,928. Seller activity showed more modest gains compared to last year. New listings rose 4.6 percent to 8,678 during the month, which is a multi-year high. It’s the highest number of new listings for any month since April 2010. Excluding March and April of 2010, new listings were at their highest level for any month since June 2008. Despite that, the number of available properties fell 9.4 percent to 16,597 homes.

“Buyers have been extraordinarily active this spring and summer,” said Mike Hoffman, Minneapolis Area Association of REALTORS® (MAAR) President. “With both pending and closed sales activity officially reaching 10-year highs, consumers— particularly first-time buyers—understand that the timing is right. Therefore, sellers are also getting strong offers quickly.”

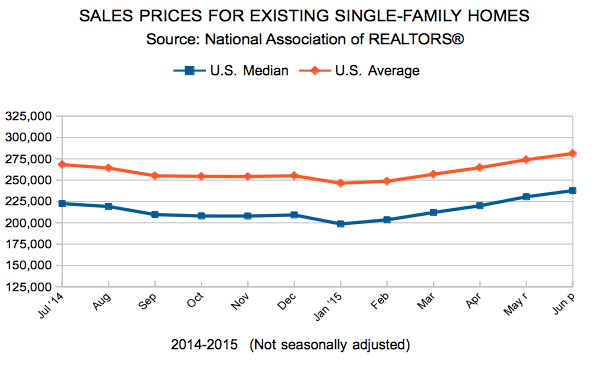

Given all this demand, the June 2015 median sales price climbed 4.7 percent to $229,900. That puts home prices within about 3.5 percent of the June 2006 record high of $238,000. However, the typical price per square foot, now at $128, is about 18.5 percent below its June 2006 record high.

The market landscape continues to favor sellers, even though it is still a historically attractive time to purchase real property. Because of the ongoing imbalance between supply and demand, the number of days a listing spends on the market fell 5.7 percent to 66 days. Sellers are accepting 97.8 percent of their original list price and 99.6 percent of their last list price. The Twin Cities metropolitan area currently has 3.6 months’ supply of inventory, which still signals a seller’s market. That figure dropped 18.2 percent from June 2014. This measure is essentially a ratio of supply and demand and indicates how long it would take to completely clear the market of all inventory assuming no new homes enter the marketplace.

According to the Federal Reserve, interest rates could still rise slowly later this year if the economy continues to perform well as it has been. Mortgage rates continue to hover on either side of 4.0 percent, compared with a long-term average of over 7.0 percent. The most recent data from the Bureau of Labor Statistics shows the Minneapolis-St. Paul-Bloomington metropolitan area has the third lowest unemployment rate of any major metro. That puts our region behind only sister cities Austin, TX and Salt Lake City, UT. Minnesota and the Twin Cities specifically are uniquely well positioned to compete in today’s global economy.

“With positive momentum in housing and the economy, agents across the region are helping buyers and sellers achieve their real estate goals,” said Judy Shields, MAAR President-Elect. “Since most sellers are also buyers, those sitting on the fence may not want to wait to make their move.”

From The Skinny Blog.