Author Archives: Pat Delaney

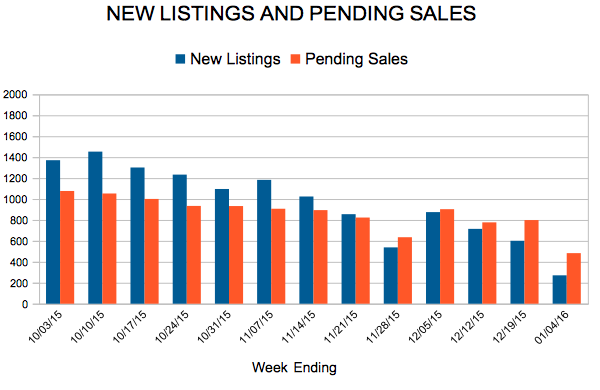

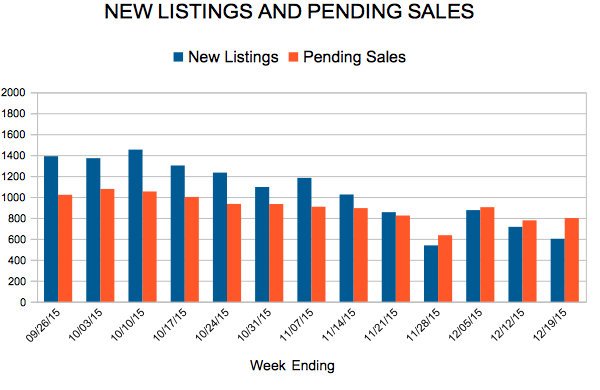

New Listings and Pending Sales

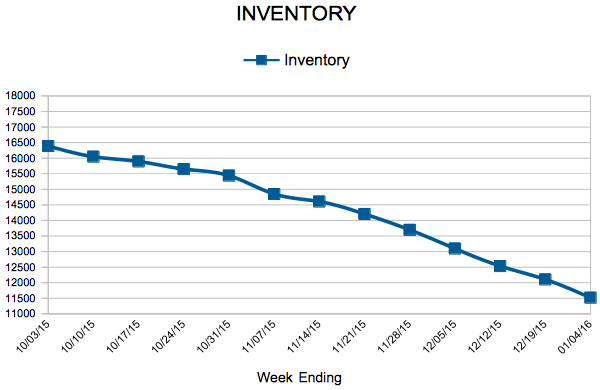

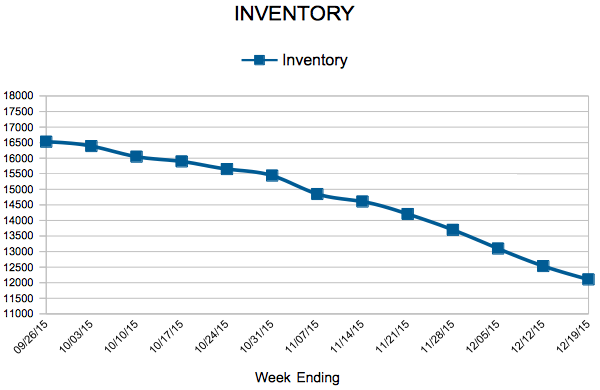

Inventory

Weekly Market Report

For Week Ending December 26, 2015

As another year winds down, we’ll be looking toward 2016 with increased interest in changes in trend lines. But as we’ve seen over the last several months, and now beginning to become multiple years, the trends have been pretty steady. The prevailing thought by national market watchers is that 2016 will largely mirror 2015 but at a more even pace. The continuation of Fed rate increases are expected to keep things in check, but the funny thing about anticipating those increases is that it tends to inspire more activity. Happy New Year!

In the Twin Cities region, for the week ending December 26:

- New Listings increased 0.7% to 271

- Pending Sales increased 39.6% to 483

- Inventory decreased 19.3% to 11,519

For the month of November:

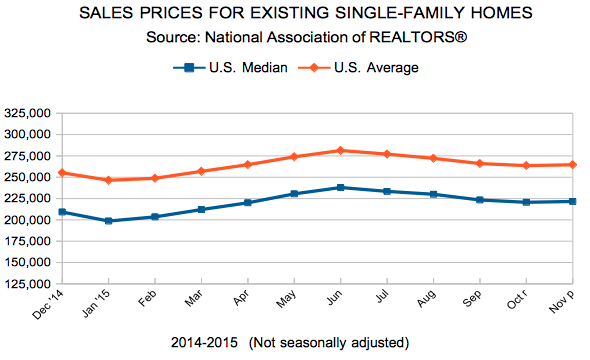

- Median Sales Price increased 6.8% to $219,040

- Days on Market decreased 7.6% to 73

- Percent of Original List Price Received increased 1.2% to 95.8%

- Months Supply of Inventory decreased 28.2% to 2.8

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

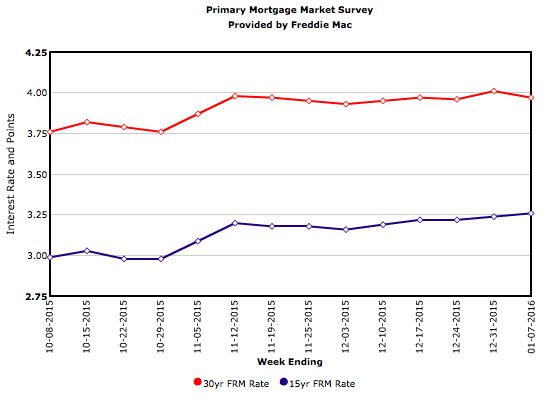

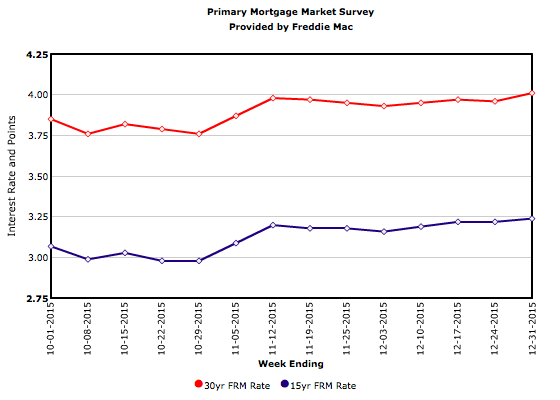

Mortgage Rates Top Four Percent

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending December 19, 2015

A week after the Federal Reserve raised short-term interest rates to .25 percent to .5 percent, the average on a 30-year fixed mortgage dropped .01 percent from the previous week to 3.96 percent, proving for now that the Fed’s effect on long-term rates is indirect when inflation is low, among other factors. Some even believe that rate hikes mean much more to Wall Street observers than home buyers. Not everyone agrees with this assessment, but residential real estate is still certainly spinning on an active axis as we work our way to a new year.

In the Twin Cities region, for the week ending December 19:

- New Listings increased 1.3% to 601

- Pending Sales increased 17.2% to 799

- Inventory decreased 18.4% to 12,105

For the month of November:

- Median Sales Price increased 6.8% to $219,040

- Days on Market decreased 7.6% to 73

- Percent of Original List Price Received increased 1.2% to 95.8%

- Months Supply of Inventory decreased 28.2% to 2.8

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.