Author Archives: Pat Delaney

Weekly Market Report

For Week Ending May 28, 2016

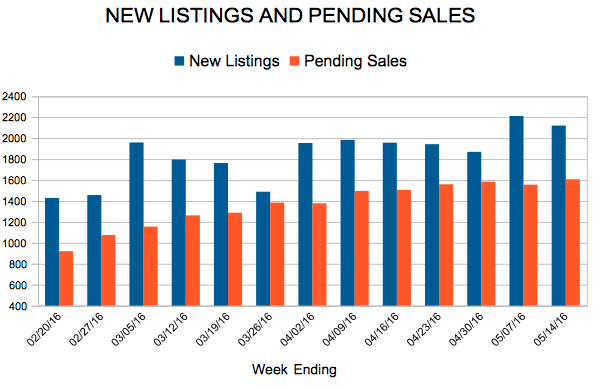

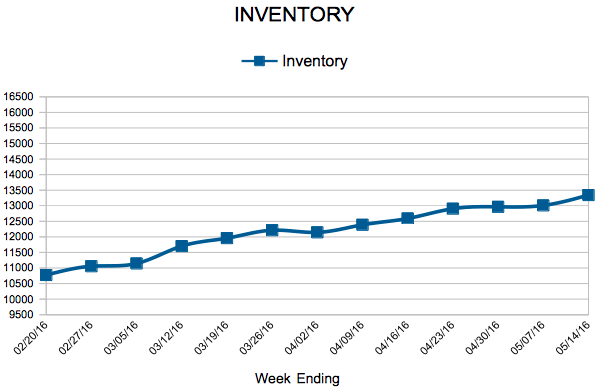

The trends of higher sales and fewer homes for sale that prevailed through the first quarter of 2016 have only gotten stronger through the second quarter. Although more sellers are listing than at this time last year, it’s still not quite enough to keep up with the heat of today’s sales environment. Buyers appear to be making great offers ahead of any hint of higher mortgage rates.

In the Twin Cities region, for the week ending May 28:

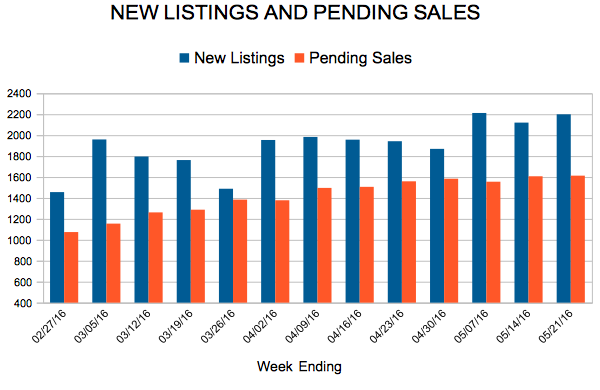

- New Listings increased 2.5% to 1,734

- Pending Sales increased 18.6% to 1,597

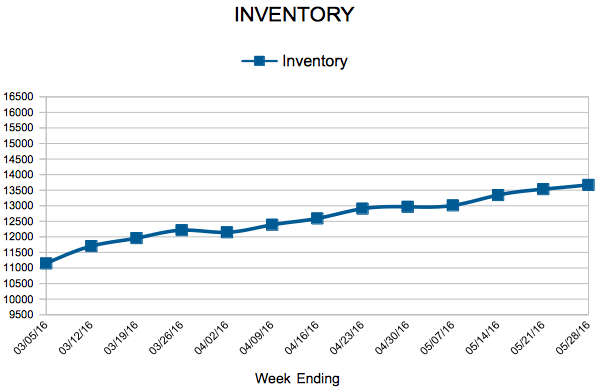

- Inventory decreased 18.8% to 13,669

For the month of April:

- Median Sales Price increased 7.6% to $231,341

- Days on Market decreased 14.1% to 73

- Percent of Original List Price Received increased 1.0% to 98.0%

- Months Supply of Inventory decreased 25.0% to 2.7

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

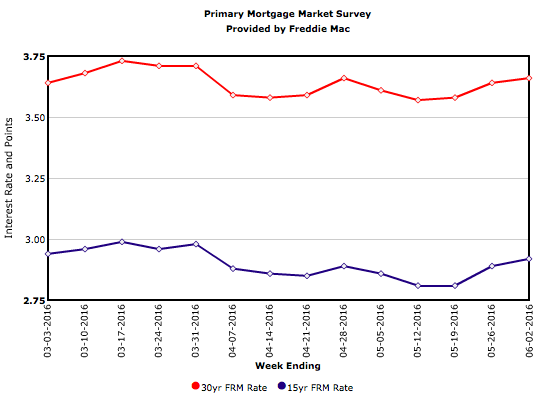

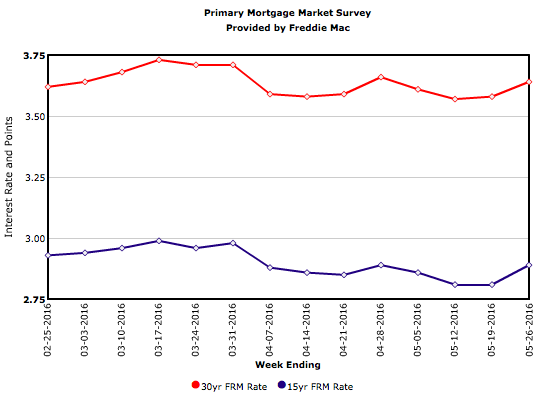

Mortgage Rates Continue Upward Trend

New Listings and Pending Sales

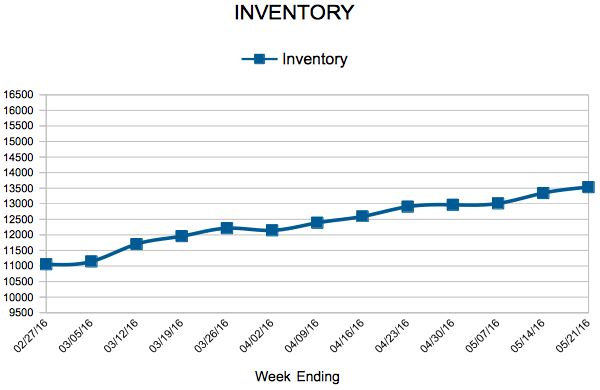

Inventory

Weekly Market Report

For Week Ending May 21, 2016

Housing has been a strong sector of the nation’s economy over the past few years, but new construction has not been growing with demand so far in 2016. Low inventory and rising prices continue to be the trends to watch. As long as the local economy stays in growth mode and aging millennials choose to buy over renting, the market should remain on an extended path of stability.

In the Twin Cities region, for the week ending May 21:

- New Listings increased 16.7% to 2,199

- Pending Sales increased 10.4% to 1,613

- Inventory decreased 19.0% to 13,533

For the month of April:

- Median Sales Price increased 7.7% to $231,450

- Days on Market decreased 14.1% to 73

- Percent of Original List Price Received increased 1.0% to 98.0%

- Months Supply of Inventory decreased 25.0% to 2.7

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortage Rates Tick Up on Fed News

U.S. Treasury yields moved up in response to the Fed minutes release, which kept alive the possibility of a summer rate-hike. Mortgage rates followed, with the 30-year fixed-rate mortgage increasing 6 basis points to 3.64 percent. Despite this increase, May ends the month averaging only 3.60 percent, 1 basis point below April’s average, and the lowest monthly average in 3 years.