For Week Ending July 9, 2016

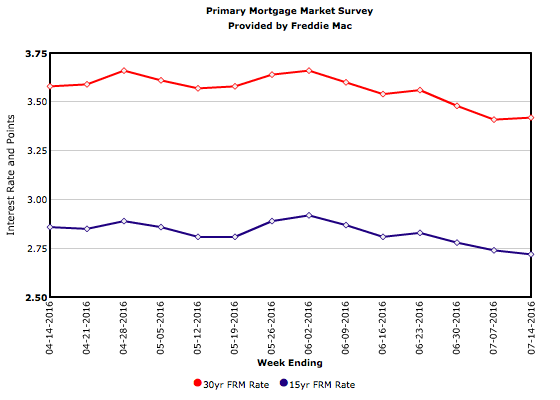

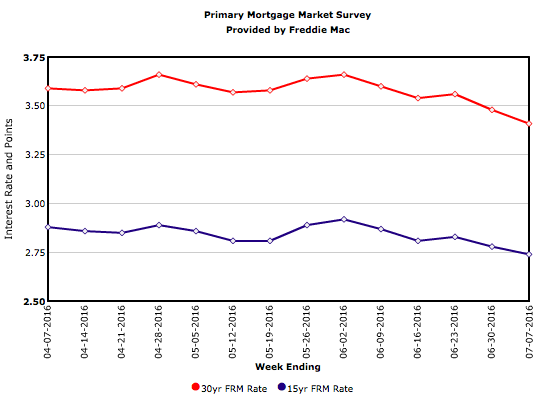

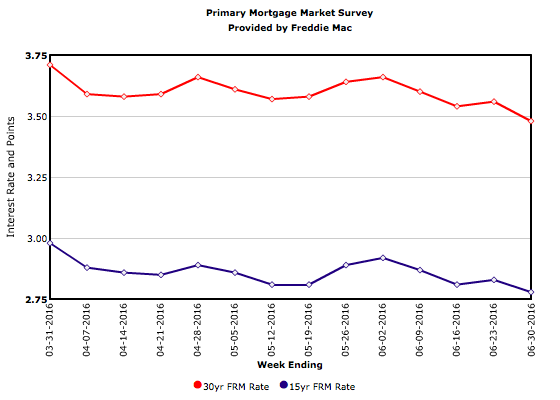

Sales have been brisk this summer, as the largest living generation in the U.S., the Millennials, enters the housing market in droves. Student loan debt is still a hindrance for many, but that has often been offset by continued low rates allowing for lower monthly mortgage payments. With rents on the rise, conditions for further sales are good, although, traditionally, the second half of summer is not as active as the first half.

In the Twin Cities region, for the week ending July 9:

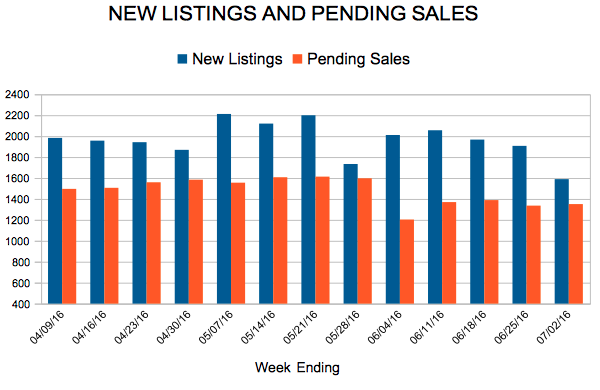

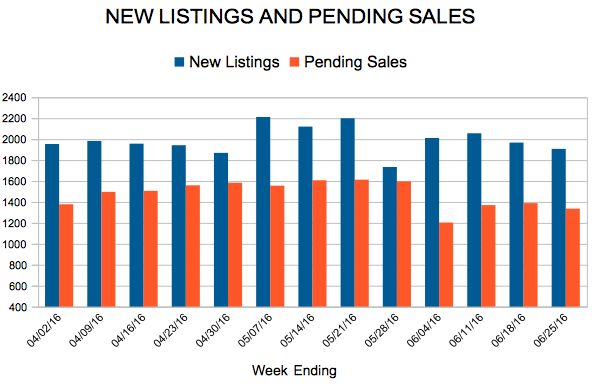

- New Listings decreased 23.2% to 1,649

- Pending Sales decreased 20.4% to 1,033

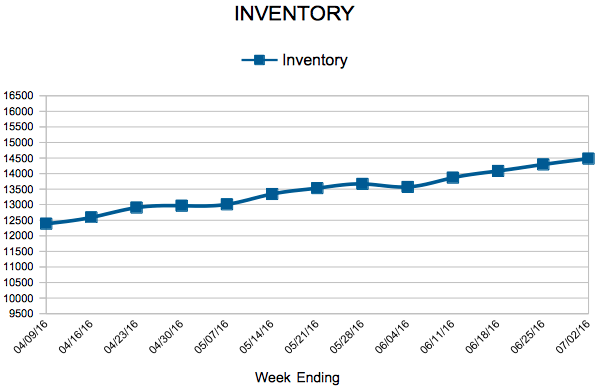

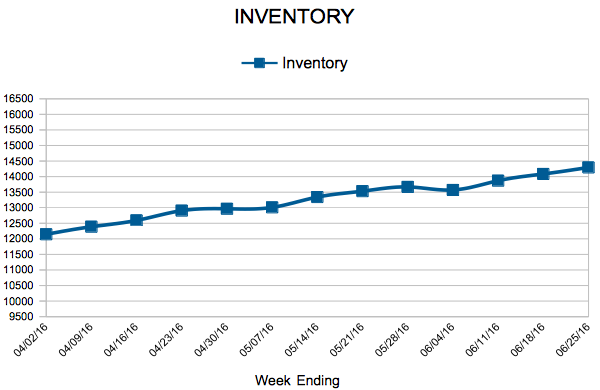

- Inventory decreased 18.5% to 14,104

For the month of June:

- Median Sales Price increased 5.3% to $242,000

- Days on Market decreased 16.7% to 55

- Percent of Original List Price Received increased 1.0% to 98.7%

- Months Supply of Inventory decreased 23.7% to 2.9

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.