Author Archives: Pat Delaney

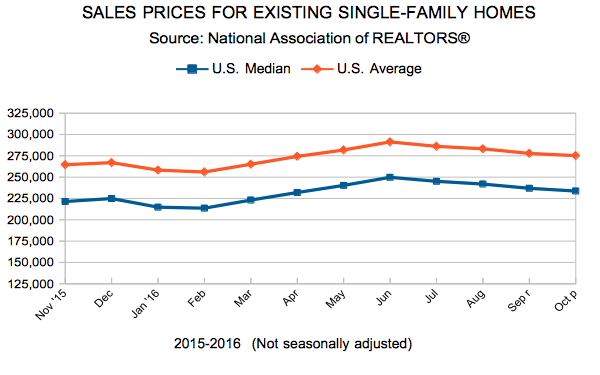

Existing Home Sales

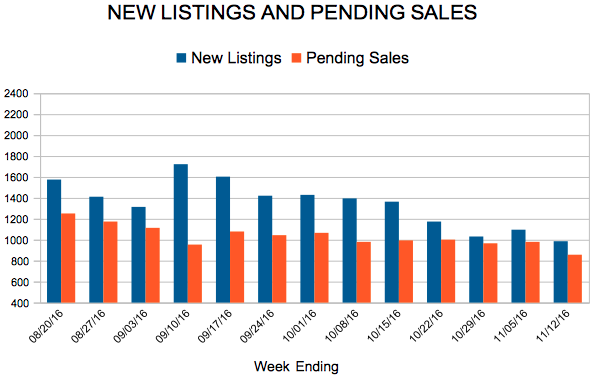

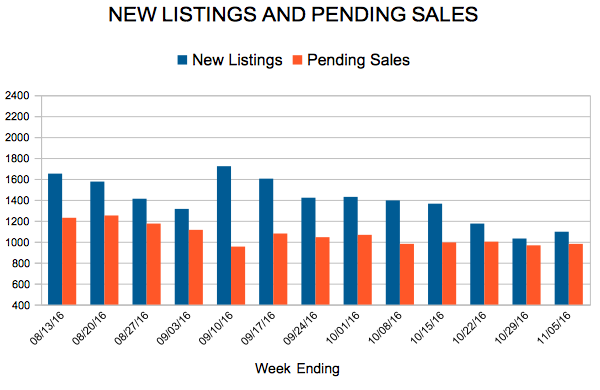

New Listings and Pending Sales

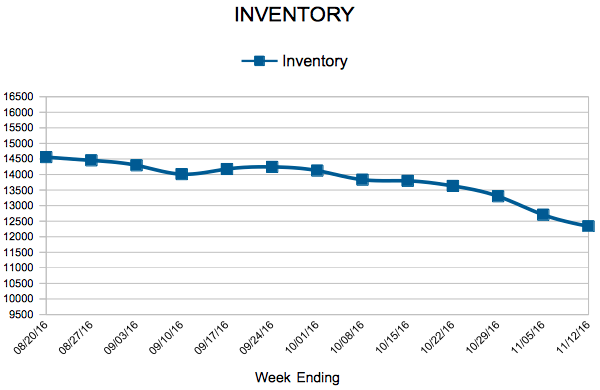

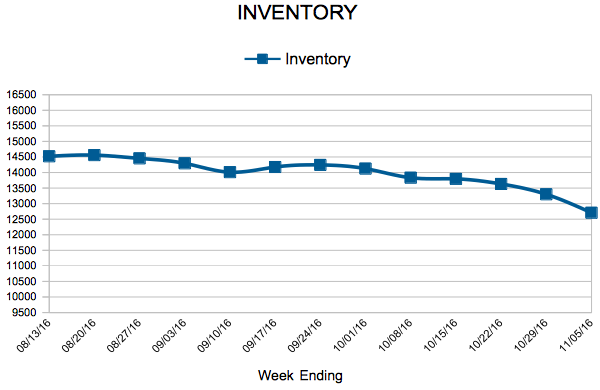

Inventory

Weekly Market Report

For Week Ending November 12, 2016

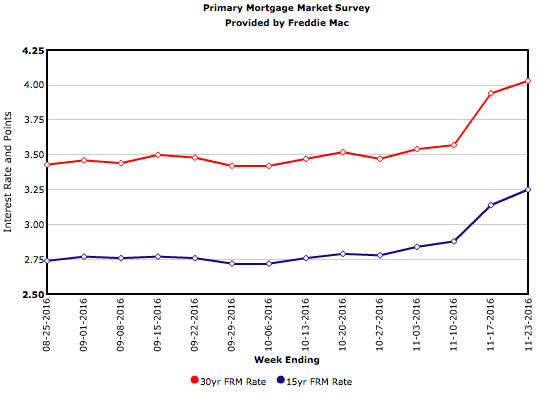

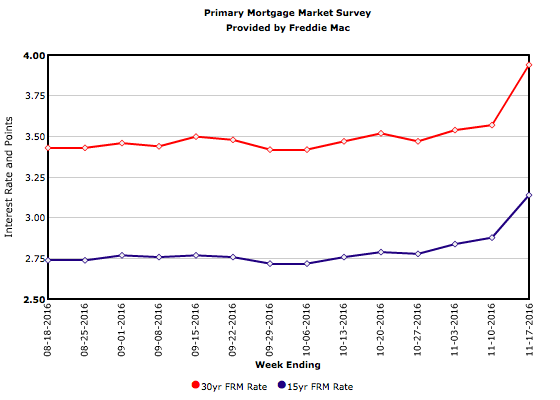

The sudden elevation in mortgage rates after the election may throw a wrench into the market for both buyers and sellers. Affordability and inventory are already low, and rate spikes coupled with rising prices may keep buyers at bay. In return, potential sellers may forgo selling if they have to lower their asking prices. These are hypothetical situations, of course, and residential real estate is presently performing well.

In the Twin Cities region, for the week ending November 12:

- New Listings decreased 3.8% to 986

- Pending Sales decreased 2.7% to 857

- Inventory decreased 19.0% to 12,334

For the month of October:

- Median Sales Price increased 6.5% to $230,000

- Days on Market decreased 14.3% to 60

- Percent of Original List Price Received increased 0.8% to 96.9%

- Months Supply of Inventory decreased 21.2% to 2.6

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortgage Rates Spike

Over the last two weeks the 30-year mortgage rate jumped 40 basis points to 3.94 percent, almost identical to the 39 basis point increase in the 10-year Treasury yield. If rates stick at these levels, expect a final burst of home sales and refinances as ‘fence sitters’ try to beat further increases, then a marked slowdown in housing activity.